Federal taxes taken out of paycheck

Complete Form W-4 and show the additional amount you want withheld from each. Federal Unemployment Tax Act FUTA is another type of tax withheld.

Understanding Your Paycheck Youtube

That changed in 2020.

. Sixty years of separate but equal. Can I deduct my moving expenses on my US. Depending on your location you might pay local income tax and state unemployment tax as well.

Check your paystub and use a W-4 Calculator to find out if you need to make any changes to your federal income tax withholding this year. I moved to the United States this year. I am married filing jointly with one dependent.

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December. For example you may have no withholding tax taken from your paycheck due to how you filled out your W-4 form for the year. The IRS urges taxpayers to use these tools to make sure they have the right.

The amount of tax that is withheld from your paycheck depends on the information you provide your employer with the W-4 form which you fill out when you begin employment for an employer. As of 2013 the top 1 of households the upper class owned 367 of all privately held wealth and the next 19 the managerial professional and small business stratum had 522 which means that just 20 of the people owned a remarkable 89 leaving only 11 of the. Dog finds unique spot to keep an eye on her community.

Positions taken by you your choice not to claim a deduction or credit conflicting tax laws or. Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4. Fiscal year revenues to date were also up 17 compared to FY2019 448 billion partly a result of increased workers wages and salaries particularly among higher-income individuals who pay the majority of federal income taxes.

Fastest Refund Possible. 215 Amount taken out of an average biweekly paycheck. Two hundred fifty years of slavery.

Federal taxes are the taxes withheld from employee paychecks. These taxes fall into two groups. 2813 Amount taken out of an average biweekly paycheck.

Ive tried to talk to IRS reps about why no federal taxes are being withheld from my paychecks and they keep telling me it is my employers responsibility. Family or financial obligations might require that you bring home a bigger paycheck each. Federal estate and gift tax in Reminders.

Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks. If you participate in a 401k 403b or the federal governments Thrift Savings Plan TSP the total annual amount you can contribute is increased to 19500 26000 if age 50 or older. Total spending in June was 623 billion a 482 billion drop compared to June 2020.

Total income taxes paid. You might want to re-fill out a new W-4 and a new California state income tax DE-4 Form. Your employer also must pay taxes for you for Social Security and Medicare.

The COVID-19 related credit for qualified sick and family leave wages is limited to leave taken after March 31 2020 and before October 1 2021. More Information on Paycheck Taxes. See Dependents in chapter 5.

My employer has no idea why they are not being taken out. However in the event that you will owe taxes claiming exemptions on your W-4 could result in an increased tax burden during filing season. Find out if you need to withhold and pay federal taxes.

Under federal payroll rules employees are supposed to pay taxes by having them withheld from their earnings unless an exception applies. The federal income tax consists of six marginal tax brackets ranging from a minimum of 10 to a maximum of 396. In the United States wealth is highly concentrated in relatively few hands.

Find out with the experts at HR Block. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Can I claim my spouse andor children as dependents.

Not sure why your employer did not withhold any federal or state taxes from your paycheck. Get ahead of your independent contractor tax obligations and check out our Filing Guide to Gig Worker Taxes. Federal Income Tax FIT and Federal Insurance Contributions Act FICA.

Ive had the same same issue for the entire 2021 year so far. If youre expecting a big refund this year you may want to adjust your withholding to have more take-home pay each pay period. Total income taxes paid.

Fastest federal tax refund with e-file and direct deposit. Paycheck Protection Program loan forgiveness. If you had no tax liability last year and no anticipated tax liability this year then you may be eligible to claim exempt on your W-4 and have no federal tax taken out of your paycheck.

Federal income taxes are paid in tiers. On the W-4 you let your employer know whether to withhold tax at the higher single rate or the lower married rate depending on your marital status. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income.

Until we reckon with our compounding moral debts. Gross Paycheck --Taxes-- --Details. Find out if you need to withhold and pay state taxes.

Tax refund time frames will vary. See Deductions in chapter 5. Ninety years of Jim Crow.

I pay income taxes to. For a single filer the first 9875 you earn is taxed at 10. Your income tax must be paid throughout the year through tax withholding or quarterly payments and.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. 672 More From GOBankingRates. Thats a staggering sum but it amounts to a true tax rate of only 34.

What is the tax rate on my income subject to US. There are also other trust funds like the Highway Trust Fund which comes from gasoline taxes. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Payroll taxes are taken out of your paycheck before you get it and might appear on your paystub as FICA SS SOCSEC or other names for Social Security. Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. They paid a total of 136 billion in federal income taxes in those five years the IRS data shows.

IR-2018-36 February 28 2018. Now you claim dependents on the new Form W-4. Any income on the excess deferral taken out is taxable in the tax year in which you take it out.

However FUTA is paid solely by employers. In the state of California your employer cant deduct anything from your wages except what is required by state and federal law for income taxes for example or what you authorize yourself. Thirty-five years of racist housing policy.

Customer service and product support hours and options vary by.

Understanding Your Paycheck

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate 2019 Federal Income Withhold Manually

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Check Your Paycheck News Congressman Daniel Webster

Paycheck Taxes Federal State Local Withholding H R Block

Adjust Your Withholding To Ensure There S No Surprises On Tax Day Tas

Here S How Much Money You Take Home From A 75 000 Salary

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

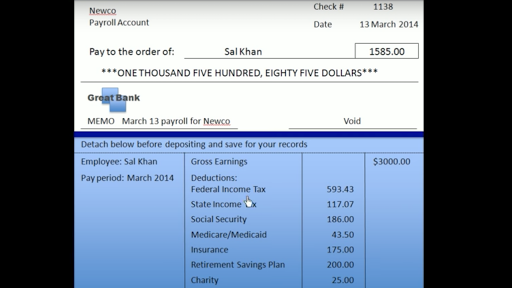

Anatomy Of A Paycheck Video Paycheck Khan Academy

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Decoding Your Paystub In 2022 Entertainment Partners

My First Job Or Part Time Work Department Of Taxation

Irs New Tax Withholding Tables

Understanding Your Paycheck Credit Com

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age